Table of Contents

Introduction

The loan origination process (LOS) is undergoing a significant transformation driven by automation technologies. This transformation integrates digital workflows to expedite application processing, enhance risk evaluation, and replace manual tasks with efficient and error-free procedures. This blog post explores the technical aspects of Loan Origination Systems Automation, its impact on various stages of the loan origination process, and the resulting benefits for both borrowers and lenders.

Market Growth and Automation Adoption

The LOS market is experiencing significant growth, projected to reach $177.1 billion by 2030. This surge is attributed to the efficiency gains and improved customer experience facilitated by automation. Key areas of automation within the LOS include:

- Pre-qualification: Automated algorithms leverage borrower data to provide real-time eligibility assessments.

- Loan Application: User-friendly online applications with pre-filled data and dynamic form validation reduce errors and streamline data collection.

- Application Processing: Integration with external data sources and document verification tools automates data retrieval and verification processes.

- Underwriting Process: Advanced Algorithms analyze borrower data and creditworthiness to generate risk scores and support automated underwriting decisions.

- Credit Decision & Quality Check: Rule-based engines enforce credit policy compliance and ensure consistency in decision-making.

- Loan Funding: Integration with electronic funds transfer (EFT) systems facilitates faster and more secure loan disbursement.

Benefits of Loan Origination Systems Automation for Borrowers and Lenders

Automation empowers both borrowers and lenders by optimizing the loan origination process. Here’s a breakdown of the key advantages:

Borrower Benefits:

- Reduced Processing Time: Automation significantly accelerates application processing, leading to faster loan approvals.

- Enhanced Data Accuracy: Automated data capture and verification minimize errors and expedite decision-making.

- Improved Customer Experience: User-friendly interfaces and real-time application status updates create a smoother and more transparent experience.

- Simplified Documentation: Automated document collection and verification reduce paperwork burdens.

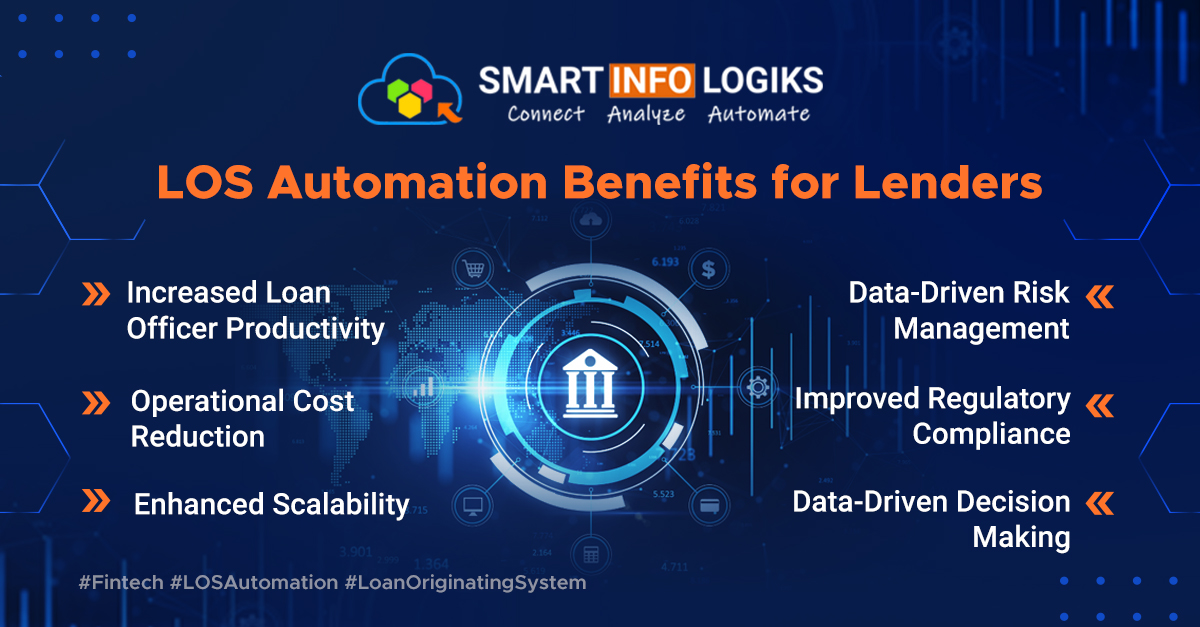

Lender Benefits:

- Increased Loan Officer Productivity: Automation frees up loan officers’ time for more strategic tasks, such as complex loan structuring and customer relationship management.

- Data-Driven Risk Management: Machine learning models provide lenders with deeper insights into borrower risk profiles, enabling more informed credit decisions.

- Operational Cost Reduction: Automation streamlines processes, minimizes manual workload, and reduces operational costs for lenders.

- Improved Regulatory Compliance: Automated workflows ensure adherence to evolving regulations and mitigate compliance risks.

- Enhanced Scalability: Automation empowers lenders to handle increased loan volume efficiently, facilitating business growth.

- Data-Driven Decision-Making: Automation facilitates data-driven decision-making throughout the loan origination process. Real-time data integration and advanced analytics empower lenders to assess borrower risk accurately, personalize loan offerings, and optimize pricing strategies.

Future Trends of Loan Origination Systems Automation

The future of Loan Origination Systems Automation involves the integration of cutting-edge technologies like Artificial Intelligence (AI) and Blockchain. AI-powered chatbots can offer 24/7 customer support, while Blockchain technology can streamline document management and secure loan transactions. Ultimately, end-to-end digital lending platforms with eClosing capabilities will revolutionize the loan origination process, offering a seamless and efficient experience for all stakeholders.

Conclusion

Loan Origination Systems Automation is a technical revolution transforming the lending landscape. By embracing automation, lenders can optimize operations, improve risk management, and enhance customer experience. Borrowers can benefit from faster approvals, reduced errors, and a more transparent loan application journey. As automation continues to evolve and integrate with advanced technologies, the future of loan origination promises to be efficient, secure, and borrower-centric.